The Dangers of Debt

Debt isn't ideal. I know that. You know that.

Ideally, we'd never have to use it. But that just isn't realistic for most of us. It's something we can rarely avoid, at least early on in our lives, but it should be measured and considered very carefully nonetheless.

It's imperative as Christians that we hold a biblical perspective of debt. Why? Because of the dangers that debt pose.

*For context, everyone in debt gets there in different ways (whether by choice or not). This article is to shed light on the dangers of debt in general. Please apply what is relevant for your situation.

Economic

Compounding Works Against You

Just like compound growth (i.e. investing in the stock market) can work in your favor, compounded debt, in the form of interest, works against you in the same fashion.

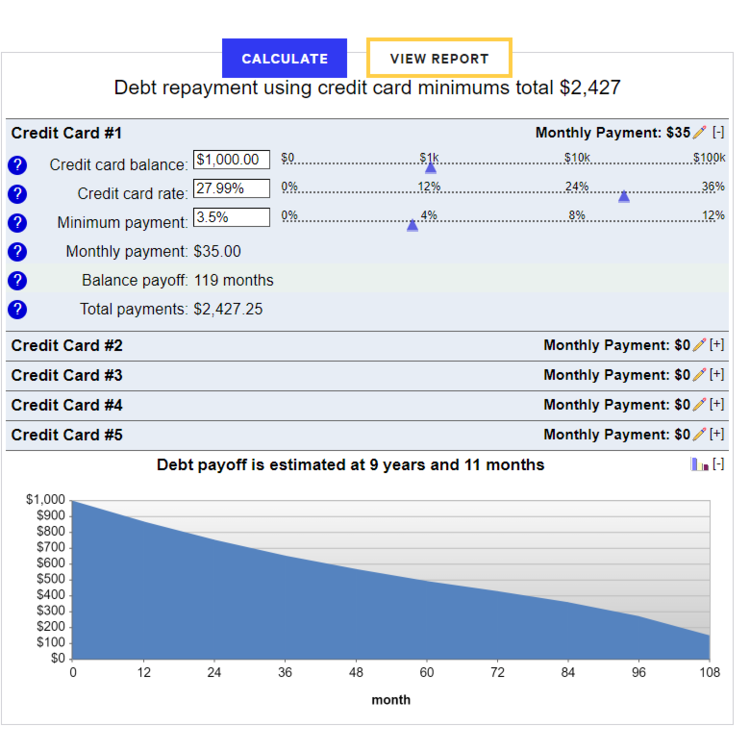

For example, your full monthly debt payment won't be going entirely towards reducing principal but paying interest first and then applying the rest towards principle. This slows the repayment process and increases the overall cost of your debt burden. See the diagram below to see the compounding effect of credit card interest.

There’s also circumstances where you may have interest being charged on interest (e.g. credit card debt) and even interest on late fees. You can see how quickly debt can spiral out of control.

Compounding growth works hard for you while you're busy working and living life, compounding debt works hard against you while you're busy working and living life.

In short, compounding means growth on growth. Growth can be good or bad depending on the side of the balance sheet. An asset can be growing FOR you or a liability/debt can be growing AGAINST you.

This illustration shows a $1,000 beginning balance on a credit card that charges 27.99% interest. Minimum monthly payments of $35 are made for 119 months to pay a total of $2,427 on a $1,000 debt. In this scenario, the credit card company made a 142% return off this borrower.

Getting in Is Easier Than Getting Out

It's easy to say yes to debt. Our culture has normalized it pretty well in the last few decades. You can finance just about anything making items easier than ever to get. The Buy Now, Pay Later (BNPL) industry is booming.

With a short application and a brief screening process you can have access to buy now and pay later. Because of that low barrier to entry it's easy to access anything and use debt for that access.

However, it's a lot harder to get out of debt than it is to get into it. The hurdle is much higher and will require much more from you. And I'm not just talking about extra money in the form of interest.

It will take a well thought out plan and strategy. It will take diligence and discipline to stay the course. It will take your full commitment to get out of debt. It will take sacrifice.

If you know anyone that is debt free ask them how they achieved that feat. I bet it just didn't "happen".

Debt Is Always Repaid With After Tax Dollars

When you receive the proceeds from a loan, or utilize credit for that matter, you don't get a tax deduction. You may get a tax deduction for the interest you pay but you repay the debt with after-tax dollars.

Put another way, the money you use to repay debt is income you've received after you've paid Social Security, Medicare, state income Taxes, federal income taxes, and potentially local income taxes.

You can see how debt will reduce your standard of living by sentencing you to a life of less. Your after-tax income is what you actually have to spend and as long as part of that income is used to alleviate debt then we'll always lack true financial freedom.

Borrowing Always Mortgages the Future

"The rich rules over the poor, and the borrower is servant to the lender."

Proverbs 22:7 (AMP)

Borrowing also mortgages the future. A mortgage is simply a debt that is backed by an asset and that asset is partially owned by the lender. So to mortgage the future means that your future income and time is owned by the lender. You've in essence traded your future for today, or in most cases the past.

This is the trade off that you’ve negotiated with the lender.

The only way to fully own your financial future outright is to be debt-free.

Spiritual

Borrowing Always Presumes Upon the Future

'Come now, you who say, “Today or tomorrow we will go into such and such a town and spend a year there and trade and make a profit”— yet you do not know what tomorrow will bring. What is your life? For you are a mist that appears for a little time and then vanishes. Instead you ought to say, “If the Lord wills, we will live and do this or that.” '

James 4:13-15 (ESV)

We’re creatures of habit and so it’s easy for us to make assumptions. It’s easy to assume we’ll go to bed tonight and wake up in the morning because we’ve done it countless times. Because of this bias our judgement is often clouded especially when it comes to borrowing.

We think we know what tomorrow will bring but we don’t know for sure. When we borrow, we believe that we’ll be able to repay that debt in the future assuming our current circumstance will remain the same but life isn’t linear like that. What if our situation changes? If anything we tend to be overly optimistic.

Sure, we’ll likely go to bed tonight and wake up in the morning and everything will be the same. But what about in a week? A year? Five years? The risk increases the longer you have outstanding debt because there’s a higher probability that something will occur in that time frame.

We're not promised tomorrow so we shouldn't sacrifice it as though we have been.

Borrowing May Deny God an Opportunity to Work (To Provide and Work Within Us)

When we borrow we are deciding to take an active role by taking things into our own hands. This isn't necessarily a bad thing in itself but we could be denying God an opportunity to provide for us OR to work within us.

Many times we're quick to act without fully considering what's really at play here. Also, how often do we skip "praying" and remaining still in order to listen to the Holy Spirit?

By borrowing we may be deterring God the opportunity to work and further transform our lives. By borrowing, we're often choosing to control our own path and destiny according to what we want instead of what God wants.

Borrowing Can Destroy Your Testimony if You Can’t Repay

As Christians, our testimony is one of our most powerful tools in displaying and sharing the Gospel. We must remember that as ambassadors of Christ everything we do or don't do reflects on Him.

I know there's grace. But for those that don't know the truth, they'll assume what's to be true based on what they know and have experienced.

That being said, everything we do should be done above reproach including borrowing. If we can't repay a debt then we shouldn't even start down the path of borrowing.

But if we borrow and can't repay, what reflection is that on Jesus? How can we advance the Gospel if we're labeled as hypocrites? We don't serve a hypocritical God and so hypocrisy should be far from us.

Psychological

Debt Adds Anxiety, Stress, Fear and More

When we borrow, or take on debt, we assume many burdens including the psychological ones. Debt has a way of provoking and fueling our anxiety, worries, and insecurities. Just like debt can mount up, so can these feelings.

Deep down we realize what's at stake if we can't repay our debt and we often even begin to envision a future of being enslaved to debt.

We worry about tomorrow, and the next day, and the day after that and so on.

Jesus was pretty clear about letting tomorrow worry about itself. But the reality is that debt has a way of directing our attention to tomorrow's worry.

We see numerous accounts throughout scripture of these types of psychological hurdles. They are all consuming to the point of obsessing over.

First, we should acknowledge that we should be casting all our psychological burdens upon Christ. However, we should also hold ourselves accountable to our debt and borrowing, especially if it’s due to our own doing, and the emotions stemming thereof.

Debt Threatens Marital Security

Marriage is built upon grace, trust, and love. Through a solid foundation and reliance on God, there's a level of security within a marriage that creates peace, harmony, and comfort. Debt has a way of slowly eroding that foundation and threatening marital security.

Will debt in itself destroy a marriage? It could. What's more likely is what debt reveals as well as the other troubles it could bring with it (untreated trauma, broken trust, conflict, etc.).

Just as debt threatens your future, it could also threaten your marriage as long as it exists.

Having a biblical perspective of debt will help guide us through this life in order to pursue and live a debt-free lifestyle that's free of the aforementioned dangers all while allowing a greater intimacy with God. This path is the only way towards true financial freedom.

The dangers of debt will always threaten our ability to steward well, our faith, and our relationships.

The tables stakes of getting into debt, and remaining in debt longer than we need to, are too high. You’ve been warned to not overlook the dangers of debt.